The sudden collapse of the FTX exchange and all of its associated organizations sent shockwaves through the crypto markets. It took less than a week to move from regular functionality to complete bankruptcy and fraud investigations! This event affected the entire crypo industry, including web3 gaming.

Once valued at $32 billion, the quick, nosedive crash of FTX and its related tokens shook the blockchain industry.

During less than a week in November of 2022, the FTX exchange platform saw rumors about lack of funds, a bank run on their held assets, a withdrawal freeze, a potential takeover bid from Binance which was quickly retracted, investigations by the SEC, more rumors about their CEO feeling to Argentina, mysterious movements of large number of tokens off of the exchange, claims that the FTX app had become malware, a general declaration of bankruptcy for FTX and all associated organizations including Alameda Research, and possible detention in the Bahamans for a number of key executives! This article has a pretty good timeline of the events so far in this debacle.

This drama has not nearly played out yet. But it has already had major effects across the markets. And is likely a leading cause for the recent drop in the crypto markets. Exchanges quickly jumped to prove they held sufficient liquid assets to cover their user’s deposits, though many still saw a significant outflow of funds as crypto users feared a cascading wave of insolvency.

FTX, Solana, and Other Web3 Projects

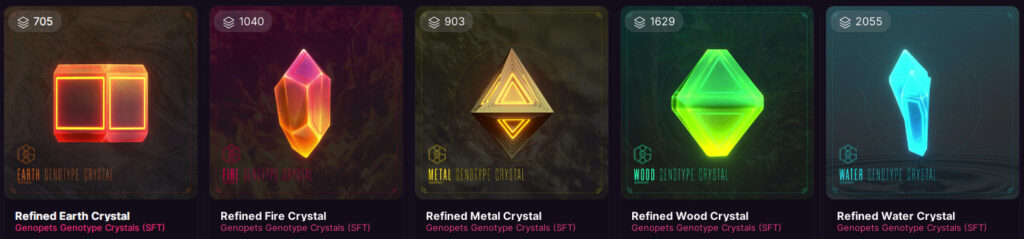

Solana took an especially hard hit, as it was heavily partnered with FTX and Alameda Research. In fact Serum, a notable DEX, or decentralized exchange, on Solana, was forced to completely redeploy their app because the upgrade keys for the system are owned by FTX! Apparently, the new SFTs from Genopets (and other projects) are utilizing the Serum DEX. And so, the Magic Eden marketplace was forced to halt all SFT trading during the upgrade (which is still ongoing at the time of this article)!

The Solana token took major blow, losing over 50% of its value over the past week. Pretty much every app and game in existence on the Solana blockchain was forced to quickly push out a statement about the safety of their user’s funds and the status of their association with FTX and related entities. Alameda Research, an investment arm of FTX, had actually invested in a number of web3 games, including Decimated.

Yuga Labs, creators of Bored Ape Yacht Club, also had FTX as one of their investors. And, up until last week, held significant funds on the FTX exchange. However, in a very timely coincidence, they managed to move their funds off the exchange before they halted withdrawals.

This shouldn’t directly affect any game development. Many NFT collections saw price crashes during all of this. But a lot of that is related to the drop in the value of the related blockchain tokens. But the fallout from token values dropping and potential future investigations into fraud relating to Alameda Research could cause some issues for game developers.

So far, everyone not directly involved with FTX is talking the good talk. Promising to stay strong, protect their users, and continue development. However, we are likely to see a lot more caution from outside investors. And there is some concern that Solana may never recover, as new developers may opt to develop their apps on a less volatile chain.

Final Thoughts

The FTX bankruptcy affected everyone in the crypto market, whether directly or indirectly.

And from what I’ve seen so far, it seems that the FTX group was run by a bunch of degenerate traders who came up with the idea to use other people’s money for their trades rather than their own. And this is certainly not unheard of. After all, it’s basically how every banking and investment institution works. However, one major difference here is that a crypto exchange won’t receive a government bailout like a bank would. And so, FTX will likely go under, the executives won’t get the nice big bonuses we see for bank executives, and the biggest investors will receive the bulk of any retrieved funds, leaving the regular folks to bear the brunt of the loss.

And for those with funds still on FTX, which includes millions from at least one venture fund, it could be years before those funds become available again. This collapse is a huge black eye for crypto in general. Especially on top of the insolvency of Celsius and Voyager earlier this year.

But, hopefully some good will come from the destruction. Perhaps greater transparency and self-regulation from exchanges? A better informed user base? Or maybe more focus on decentralization and higher quality of exchanges, both centralized and decentralized? It’s hard to predict, but crypto, and web3 gaming are here to stay, despite any setbacks along the way.